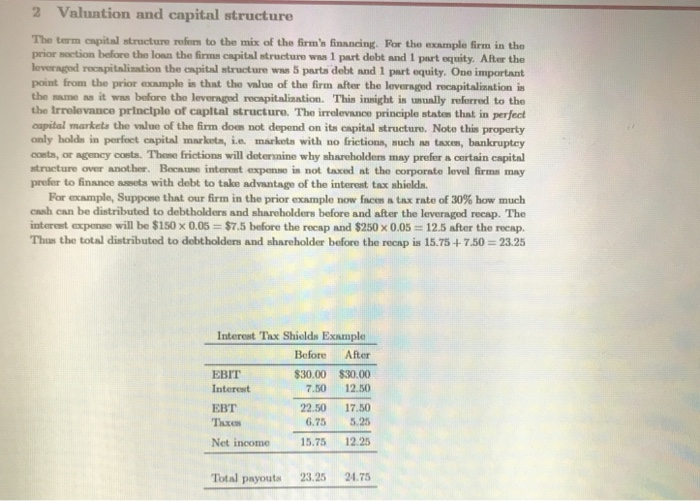

interest tax shield example

12063 30000 333 35 30000 10 35 7513. That is the interest expense paid by a company can be subject to tax deductions.

How Tax Shields Work For Small Businesses In 2022

Income tax deductibility tax shield Interest is a reduction to net income on the income statement and is tax-deductible for income tax purposes.

. Despite having a cash pile of nearly 35 billion in September 2021 the company carried long-term debt of about 162 billion. Such a deductibility in tax is known as. For example a mortgage provides an interest tax.

Tax Shield Tax Rate x Value of Tax-Deductible Expense. Suppose company X owes 20m of taxes. Tax Shield formula is straightforward and expressed as follows.

This tax shield example template shows how interest tax shield and depreciated tax shield are calculated. Cash outflow in year 2. A Tax Shield is an allowable deduction from taxable income that.

Therefore if your tax rate is 20 percent and you have 2000 in mortgage interest your tax shield will be 400. Interest Tax Shield Calculation Example Terminal scrap value of 20000 is realizable if the asset is purchased. Tax Shield Value of Tax-Deductible Expense x Tax Rate.

Credit AnalystCMSACapital Markets Securities AnalystBIDABusiness Intelligence Data AnalystSpecializationsCREF SpecializationCommercial Real Estate FinanceESG. Apple is a well-known example of this. The value can be calculated by the interest expense multiplied by the companys tax rate.

The company provides a 10 depreciation on the straight-line method. In order to calculate the value of the interest tax shield you may use this interest tax shield calculator or calculate the value manually like we. Tax_shield Interest Tax_rate.

Thus there is a tax savings. Tax Shield Deductible Expenses Tax Rate Lets take a simple example to apply the above. A reduction in tax liability coming from the ability to deduct interest payments from ones taxable income.

A companys interest payments are tax deductible. Formula for Tax Shield. Interest Tax Shield Interest expense Tax Rate.

The value of these shields depends on the effective tax rate for the corporation or. Another example is a business may decide to take on a mortgage of a building rather than lease the space because mortgage interest is deductible thus serving as a tax. Cash Outflow in Year 1 Annual repayment Depreciation tax shield Interest tax shield.

So for instance if you have 1000 in mortgage interest and your tax rate is 24 percent your tax shield will be 240. Interest Tax Shield Example. This companys tax savings is equivalent to the interest payment.

A company carries a debt balance of 8000000 with a 10 cost of debt and a 35 tax rate. A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owed. Credit AnalystCMSACapital Markets Securities AnalystBIDABusiness Intelligence Data AnalystSpecializationsCREF SpecializationCommercial Real Estate FinanceESG.

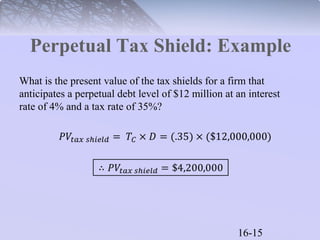

Chapter 16 Capital Structure Chapter Outline 16 1

Tax Shield Definition Example How Does It Works

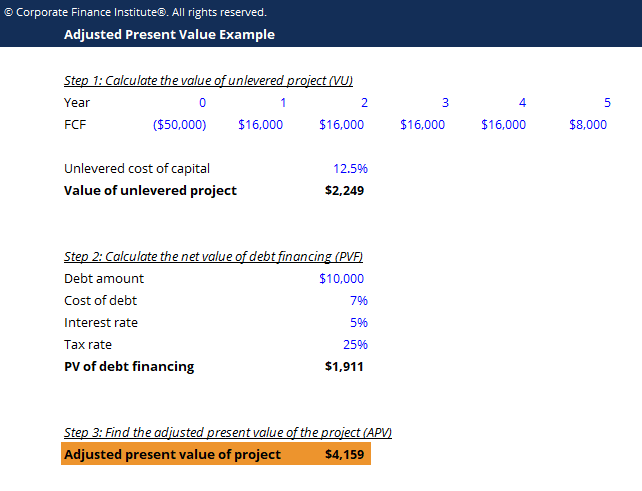

Adjusted Present Value Template Download Free Excel Template

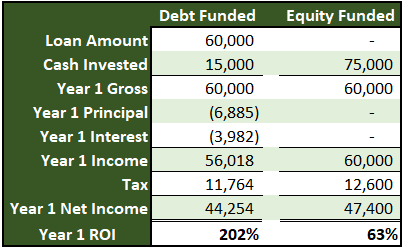

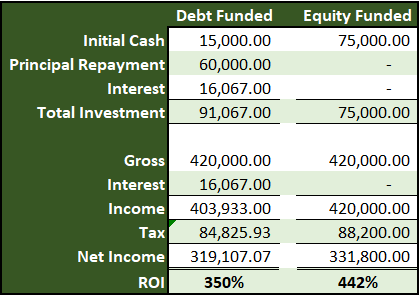

Tax Shield Approach Meaning Depreciation And Interest Tax Shields

Value Of Tax Shield Explained Mba Mondays Darwin S Money

Chapter 16 Capital Structure Chapter Outline 16 1

Tax Shield Definition And Formula Bookstime

Tax Shield Formula Examples Interest Depreciation Tax Deductible

What Is The Present Value Of The Interest Tax Shield Chegg Com

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-03-2c4a6ea86c4b4b13b8a440cee78fac7d.jpg)

Free Cash Flow Fcf Formula To Calculate And Interpret It

Risky Tax Shields And Risky Debt An Exploratory Study

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

The Trade Off Theory Of Capital Structure